Draining the Crypto Swamp It was just a couple of months ago when Elon Musk got sued by SEC with a substantial fine for a series of tweets that resulted in stiff market manipulation. But, when it comes to cryptomarket boisterous manipulations by the high school dropout celebrities and self-styled crypto experts, we still do not see any actual and consequent reaction by the US Regulator nor by any other authority in other countries. Why? One important reason appears to be the lack of specific legal instruments. The other reason is indeed the overall murkiness of the cryptomarkets, which is sadly misconceived as the expression of market freedom. The opacity of the cryptosphere has become a fertile pasture for all kind of predators, fraudsters, reckless market manipulators, celebrities either directly organizing or on the payroll of pump & dump gangs, token hooligans for hire, etc.. The worst are the self-styled online crypto publications and broadcasts including those under the well...

Posts

Showing posts from 2018

Crypto Crash: Beyond Crydiving and Voodoo Dolls

- Get link

- X

- Other Apps

BTC, LTC and a few other mineable coins are all good vehicles for value transfer. This has been proved time and again. They currently allow for around $200B dollars transfer every single month. They work efficiently as a unit of account as well. The real problem is how effectively they perform as storage of value in the mid to long term. Extreme volatility is what we are globally witnessing across all exchanges. Everybody agrees on the diagnosis, nobody offers a convincing culprit. However, in my view, the market manipulation bears a major responsibility. Right now the exchanges (possibly except Gemini) are no man's land where all doors are open to reckless crypto bot launchers and P&D gangs. Add also the internecine warfare of tokens and coins hooligans against each other across both social media and exchanges. Can we put some order into the chaos? Yes. We can experiment by forcing the exchanges to abide by the international regulatory rules. This should be done with 2 initial...

Crypto Crash: When Market Manipulations Generate Disaster

- Get link

- X

- Other Apps

Based on the behavior, we have to distinguish between 2 main classes of bots across the cryptomarkets: - Traders - Manipulators The first group operates based on the anticipation of trends and patterns by feeding on historical and real-time data. The 2nd class of bots follows increasingly a swarm logic that serves a different purpose: Poisoning the market "wells" to feed the first category of bots with real-time fake data. By serving such strategies, these bots constantly act to promote or to prevent certain trends and patterns and hence behaviors in and by the average trader bots (and humans) that move along a predictive line of reasoning. This is a de facto poker game: Trading has become gambling!! Given that these hostile bots are run by rival Pump & Dump gangs and franc tireurs across highly fragmented and unregulated exchanges, there is always the possibility of triggering either a virtuous or vicious cycle that could become very powerful via an echo chamber effect....

What does it take to generate a significant crypto FOMO wave?

- Get link

- X

- Other Apps

FOMO, or fear of missing out, is defined as a "Pervasive apprehension that others might be having rewarding experiences from which one is absent, FOMO is characterized by the desire to stay continually connected with what others are doing." (Wikipedia) Here is the break down of a crypto FOMO wave: 1- Ad hoc and well-publicized interviews followed by huge bots- operated retweets, Reddit messages, LinkedIn posts, etc. 2- News leak of a "new product" bringing about an unclear "disruption", followed by bots and humans social media amplification. 3- A huge wave of 'wash trading' to generate the appearances of a sudden expanding market liquidity. 4- A massive 'swarm layering' operated in one of the main crypto exchanges across the world to create fake 'support'. 5- 'Arbitrageur' bots push to flatten the market prices upward while 'front-runners' fill up their bags as never before. HFTs and...

Are HFT-based market manipulations the endgame for cryptocurrencies?

- Get link

- X

- Other Apps

The short answer is, not quite yet. The long answer requires more words. We should agree the main cause of the wild volatility of the cryptocurrency markets resides in the massive use of bots and hashtag # HFT . This statement becomes clear if we consider that more than 80% of all crypto trades are reportedly conducted by bots versus the 50% on the US stock market (40% in Europe and Japan). We may argue that HFT helps to increase the liquidity and to stabilize the crypto markets. Yet that is not entirely confirmed by observations and analysis. In fact, HFT offers a suitable context for more complex and stealthy methods of market manipulations based on 'swarm layering' and systematic wash trade. These reckless manipulation techniques offer also an opportunity for mutual attacks by followers of cryptocurrencies in close competition. The overselling of hashtag # ETH and hashtag # LTC and the unexplainable declining price could arguably be attributed also to such methodical ass...

A Decade of Cryptocurrency History to the Chagrin of Gloomy Naysayers

- Get link

- X

- Other Apps

The Bitcoin network was created on January 3, 2009 with the release of the first Bitcoin client, wxBitcoin, and the issuance of the first Bitcoins. The major revolutionary merit of cryptocurrency's underlying technology has been to create a reasonably solid solution in the world of bits and bytes for what goes as "double spending". And by doing this it has brought a good deal of sunshine to what has traditionally been seen as the arcane called *fiat currency*: Nowadays, an increasing number of people across the planet easily understand that money as we know it, is nothing more than a politically controlled and manipulated system for storage, transfer, and accounting of value. Many realize there is no heavenly magic behind the money they use on a daily basis. Once the enigma is gone, what remains is just a simple historical human invention: A technology called 'money' that, like many other inventions, could be redesigned, transformed and improved to better serve th...

ICO IS DEAD, LONG LIVE THE ICO!

- Get link

- X

- Other Apps

More than 95% of post-ICO startups fail for a number of reasons such as bad business concept, inadequate execution, inexperience, unpredictable market events, etc. ICO, or whatever we want to call this new fundraising paradigm, by far is not the direct cause of failure nor, on the other hand, can it be considered as the mantra to make disappear major business model and execution inefficiencies. We need to keep in mind: ICO is just a new model, a fresh approach that tries to solve a fundamental problem of the entrepreneurship life cycle, which is not related to the performance of a startup team but to the accessibility tout court : The main goal of ICO is the democratization of access to investment capital. Any critique of ICO should ultimately offer a workable solution for the accessibility issue otherwise it becomes ultimately a shallow ideological prejudice with the inevitable resulting dogmatic rejection of any innovative approach. Until we elaborate a better re...

Can massive swarm cryptomarket manipulations unleash catastrophic unplanned consequences?

- Get link

- X

- Other Apps

The short answer is yes. The long answer needs a few clarifications. We can distinguish between at least 2 categories of bots operating across the cryptomarkets: - Trader bots - Manipulator bots The first category has a modus operandi based on complex predictive modeling, that is, the anticipation of trends and patterns. The 2nd class of bots follows a swarm logic and pursues a different goal: Its purpose is to feed the first category of bots with fake data. By adopting such strategies, this class of bots constantly acts to promote or to prevent certain trends and patterns and hence behaviors in and by the average trader bots (and humans) that move along a predictive line of reasoning. Given that these bots are run by rival and non-coordinated groups and individuals across structurally hyper-fragmented and unregulated cryptomarkets in a High-Frequency Trading context, there is always the possibility of triggering either a virtuous or vicious cycle that could become ver...

Could crypto Exchanges run market manipulation schemes?

- Get link

- X

- Other Apps

After my recent posts on 'swarm layering', a reader asked a chilling question: "Do you see any possibility cryptocurrency exchanges could somehow support swarm layering schemes by using bots?" My response is that I still do not have any specific piece of evidence to prove such manipulations by exchanges but I can't exclude the possibility either. Objectively, pressed under the competition and particularly starting the activity, exchanges may have a strong motivation to use 'wash trade' artifice to create misleading artificial activity in their marketplace. They might well unloose their bots and follow a 'swarm logic' strategy to achieve deceitfully their manipulative goals. Exchanges could unleash a swarm army of bots to put in place an anti-flash-crash barrier to avoid bad press and serious financial damages. But the same exact bots could also be deployed to pursue complex market manipulations objectives by generating e.g. massive but entirely fak...

Beyond Trade Spoofing and Layering: CRYPTO SWARM LAYERING

- Get link

- X

- Other Apps

Those who follow closely the cryptomarkets should know that it is "against the law to spoof, or post requests to buy or sell futures, stocks and other products in financial markets without intending to actually follow through on those orders." Anti-spoofing is indeed part of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act passed on July 21, 2010. But the reality of crypto trading in 2018 has gone way beyond our lawmakers' imagination by creating what I call "swarm spoofing," or more appropriately "swarm layering." Swarm layering uses a mixture of two techniques to achieve its market manipulation objectives. One procedure is based on human trade agents structured in ad hoc online groups via specialized media and social media facilitation. The other method is based on a massive utilization of cryptobots in the exclusive context of High-Frequency Trading (HFT). What distinguishes both techniques is their use of a logic based on Swa...

Is 'Swarm Layering' Choking the Cryptocurrency Trading Markets?

- Get link

- X

- Other Apps

Layering is a strategy where a trader makes and then cancels orders that never intends to have executed in hopes of influencing the cryptocurrency price. (See also: Wikipedia) Based on my empirical observations, I argue that this artifice is massively used to generate fake levels of support and resistance with the goal of producing a controlled sideways market forced on Bitcoin and extended to Altcoins, especially the top-tier ones. If Layering is pursued by a handful of traders, it would be relatively easy to identify the perpetrators and face them with adequate punitive measures either based on an existing regulatory framework and/or a carefully crafted user policy. But there seem to be at least two techniques that allow this kind of systematic market manipulation to continue undisturbed. The first one uses the well-known crypto signals and trade recommendations often based on structured and paid levels of individual membership. The second technique is based on a massive utilizati...

Cryptosphere: Regulatory Framework and Risk Management

- Get link

- X

- Other Apps

Regulatory and risk issues related to cryptocurrency field can't be efficiently and with relatively high confidence resolved within the existing nation-state jurisdictions nor can the current international organizations' configuration handle such a new and highly complex fintech field. We can put together the best regulatory and risk management frameworks but without having any real possibility to enforce them, we are simply stuck. Any way out of this complicated cul de sac? Here is the simple rule of thumb: When and where we can't deploy uniformed agents we have to create and put to work AI agents with the right toolset. In other words, the only reasonable possibility of solutions could be thought out and pursued through the advanced technology implementation and deployment. The two basic components of such a technical resolution are respectively (a) Smart Contracts (b) Swarm Intelligence. We still do not have companies focusing specifically on...

PERSONAL ICO: IPTO (Initial Personal Token Offering) as DIY Scholarship

- Get link

- X

- Other Apps

This is an advice I am giving the young people who are willing to go to college, grad school and higher but they lack the resources for doing so. I simply suggest to tokenize their future expertise, that is, create tokens to presell their future consulting services. But this is indeed nothing new: Ask yourself why many smart companies pay the grad school tuition for their employees or why the US Army, for instance, offers scholarships to recruits, etc.. Personal ICO based on tokenization is just a digital abstraction of the same exact process managed on an individual level and as a self-organized professional advancement. Here is the simple DIY recipe: Manage your future as a "startup" with a "personal business plan" then launch your IPTO (Initial Personal Token Offering). Contact me for further insights.

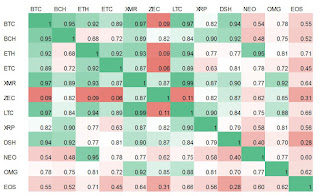

Cryptocurrencies Correlation Coeficient: Bitcoin The King

- Get link

- X

- Other Apps

In the financial markets, the correlation coefficient is used to measure the correlation between two securities. When two stocks, for example, move in the same direction, the correlation coefficient is positive. Conversely, when two stocks move in opposite directions, the correlation coefficient is negative. (Investopedia). If we extend the concept to cryptocurrencies and make the measurements for the last 30 days we obtain the table above. (Thank you, John Young!) Solid green represents the max linear correlation (+1) and the solid red for no linear correlation (0). It is not difficult to see a small group walking in lockstep while solidly headed (dragged?) by King Bitcoin. I do have my explanation but am damn curious to learn about yours. Please chime in.

Cryptocurrency Market Manipulation via Swarm Intelligence: A Crime or Cryptomonetary Policy Tool?

- Get link

- X

- Other Apps

Is cryptomarket manipulation via Swarm Intelligence a financial crime? In all my previous analytical notes, I have always considered the cryptomarket manipulation from a negative point of view and as a potential financial misconduct. What if we reverse the perspective and analyze the manipulation via Swarm Intelligence in terms of a de facto implementation of cryptomonetary policies similar in their effects to those policies traditionally exercised by the Central Banks? In other words, the use of Swarm Intelligence allows managing both the inflation and the exchange rate for every single cryptocurrency offered across the world regardless of any given nation-state jurisdiction. It also allows creating a dynamic hierarchical structure among the cryptocurrencies based on a mathematically predefined and enforced correlation coefficient to Bitcoin as the (currently) leading cryptocurrency. Therefore, it would be enough to feed core cryptobots with the needed parameters just for Bitcoin ...

Cryptomarket Manipulation, Swarm Intelligence, and Market Stagnation: Cui Bono?

- Get link

- X

- Other Apps

Can cryptomarkets survive the extensive manipulation based on bots running swarm intelligence? The global, massive and uninterrupted presence of 1000s of cryptobots manipulating their way throughout the globe, seems to wreak havoc across all the exchanges. The main critical signs of this crescendo are low and stagnating prices accompanied by the weakening volume of transactions both the current and the projected ones for the upcoming quarters. The manipulation largely follows the same game plan of a couple of weekly short-breathed P&D succeeded by annoying spoofs and apparently foolish wash trades. Some cryptobots are still profiting from yet possible arbitrage thanks to tiny but evanescent spread across the exchanges but the overall scene remains problematic. A first relevant question is whether there is any actual endgame in sight for this apparent trade lullaby. The other question is whether bigger exchanges are doing some heavy lifting underneath to keep things going ...

Cryptomarkets Manipulation: The Rise of Virtual Whales

- Get link

- X

- Other Apps

The average crytpotraders work around opportunities based on predictions. The statistics-based prediction and prediction-based market moves are the very foundation of the average trader's strategy. This is about the trading based on the anticipation of market dynamics. "Market shaping" or "market manipulation' strategies pursue a totally different goal: Their purpose is to impact traders behavior at any given moment. Market shaping strategy is arguably based on a binary methodology that proceeds along the double helix of "Self-Fulfilling Prophecy" and "Self-Defeating Prophecy" principles. By adopting such strategies a market whale acts to promote or to prevent certain beliefs and hence behaviors in and by the average traders who move along a prediction-based line. The manipulator's goal is to dynamically shape the market reality to achieve certain results. The major transformation we are witnessing is the gradual transition from 'whale...

Crypto World: Eppur Si Muove!

- Get link

- X

- Other Apps

Interesting events buried under the daily politainment (political entertainment) lava coming out of Washington D.C. volcano: The Marshall Islands formally launched its sovereign cryptocurrency 'SOV'. Although a tiny republic, this country is the first one that, without being under any foreign sanctions, is launching a sovereign cryptocurrency as its legal tender in parallel to the U.S. dollars. Besides the Venezuelan 'Petro', the success (or failure) of this experience offers a real-world model and an alternative solution for many countries either having serious difficulty with their own disgraced legal tender or are forced to use US dollar. The Argentine Banco Masvestas abandons for good SWIFT for its international money transfer in favor of a new solution based on Bitcoin. This is the first official bank putting an actual nail in the coffin of U.S. dominated SWIFT. Santander might be the next one. Russia has developed its own system for financial transfers that ...

Is Cryptocurrency Trading a Rigged Game?

- Get link

- X

- Other Apps

Is cryptocurrency trading a rigged game? Can it survive the AI-powered *market shaping*? Can criminal probe and regulatory interventions make any difference? How does the rise of cryptobots impact the markets? and what is the relationship between cryptobots and P&D online groups? During my most recent empirical studies, I realized that bots use two techniques to heavily impact the market according to a dynamically adjustable implementation plan: a) HFT with a massive use of both fake buy and sell traffic as well as "wash trading" by single account holders, which inevitably require access to a very large fund and/or some significant "assistance" by the trading platform. b) HFT with the same effects as above but implemented by using *swarm* approach that generates a gigantic *virtual cryptobot* or Virtual Whale without any large fund. The latter seems the result of a very close integration between P&D schemes and HFT. This integration is reinforced by a car...

How to Understand Cryptomarket Turbolences

- Get link

- X

- Other Apps

There are 3 important market forces whose actions and interactions seem largely determining the cryptomarket rises and falls. They are as follows: A) The generalized actions of *cryptobots* that run reportedly 60% to 80% of the transactions and the overall Order Book activities across all the major exchange platforms; B) The *Pump or Dump Signals* generated by all size online P&D groups increasingly with 10s of 1000s of members recruited on a daily and/or permanent basis; C) The manipulative maneuvering of media outlets, social media peddlers, celebrity influencers all working as *bounty hunters* for the so-called *team investors* aka P&D online groups. If we carefully keep track of these 3 factors including their combined interactions then we simply discover that both the traditional *technical analysis* and the analysis based on some hypothetical "intrinsic value" of this or that coin or token become largely irrelevant. What should be the guideline for the s...

How to Get Rid of Eductional System Inefficiencies

- Get link

- X

- Other Apps

Ways Blockchain can help: 1) Blockchain can help eliminate paper. 2) No more need for a central authority. 3) Educational institutions will save money. 4) Blockchain-based cryptocurrencies will simplify payment systems. All that helps to progressively get rid of Brick & Mortar educational system blackhole and move towards cost-effective universal e-learning.

Crypto Bullshit: Cryptocurrencies Markets Nonsense Analysis

- Get link

- X

- Other Apps

During the last few months, I have been empirically observing the daily charts across the major exchanges as well as reading through almost all the cryptocurrency market comments and analysis (including the so-called technical ones) for a paper that I am preparing for an ongoing contract research project of one of my firm's clients. I have focused particularly on the analysis related to the current ups and downs of Bitcoin, Ethereum, and Litecoin. And now I am just shocked: With the exception of a very few cases, I have never ever read such an amount of nonsense, clueless analysis, and utter BS. To make things worse, in many cases, the titles of the articles have basically nothing to do with the articles' content while the titles themselves appear as clearly been chosen to manipulate the distracted readers. Here is my question: Aren't we entitled to have decent cryptocurrency market-related comments and analysis? While I understand that this is a new field and...

Cryptocurrencies & Looming Trade War

- Get link

- X

- Other Apps

WILL BITCOIN AND ALTCOINS BECOME SOONER THAN EXPECTED THE ONLY OPTION BOTH FOR PEOPLE TO KEEP THEIR LIFE SAVINGS, AND COUNTRIES TO SALVAGE THEIR MONETARY RESERVES? China holds $1.17 trillion of U.S. government debt. If there is a trade war, China could swiftly reduce its U.S. debt holdings as a political weapon against the Trump administration tariffs proposal. If that happens, the dollar could fall and other countries could follow suit and sell their holdings. At that point, cryptoassets (Bitcoin, Litecoin, etc. ) will become the only realistic alternative.

Welcome to The New World of CRYPTOBOTS!

- Get link

- X

- Other Apps

Assessing the percentage of cryptocurrency transactions made by cryptobots instead of humans is not an easy task. Cryptocurrencies are largely unregulated and businesses don’t have to report always their trading volumes. According to some informal estimates supported by my personal empirical observations, we may already put the rate of automatically-made trades between 60% and 80%. Keep in mind that factors such as the arbitrage opportunities still present across platforms, cryptocurrency’s minimal transaction fees, the non-stop trading, the ability to drastically decrease network latency and, last but not least, the rising number of cryptobot startups and coders-- are all helping to promote a fast-growing adoption of Autonomous-AI-powered brokerage Here is the relevant question: How does the rise of cryptobots impact the market? They would certainly help to flatten prices across the exchange platforms and promote stability. They may be instrumental to stop flash crashes in cryptomarke...

Voice Assistant and Older Adults Lifestyle

- Get link

- X

- Other Apps

I was recently interviewed via email by Laurie Orlov (Founder of Aging in Place Technology Watch ) for a research project on voice assistants and more in general voice-first solutions for aging adults. The project’s goal wasn’t to publish the interview so I decided to publish it with the hope to directly contribute to the ongoing debate. 1. Your role and the mission of your organization. My name is Max Mansoubi. I am a former research fellow and lecturer of Methodology of Field Research and General Informatics for Communication Sciences. I have also a solid advanced humanistic studies foundation besides almost three decades of hands-on technology design and development experience. I am the founder and principal consultant at Mansoubi & Associates, a tech startup advisory firm based in the Silicon Valley area. Our business is specialized in assisting startup entrepreneurs, mainly in the AI field, to define, design and implement their products and/or services with ...