Cryptocurrencies Correlation Coeficient: Bitcoin The King

In the financial markets, the correlation coefficient is used to measure the correlation between two securities. When two stocks, for example, move in the same direction, the correlation coefficient is positive. Conversely, when two stocks move in opposite directions, the correlation coefficient is negative. (Investopedia).

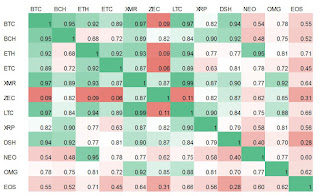

If we extend the concept to cryptocurrencies and make the measurements for the last 30 days we obtain the table above. (Thank you, John Young!) Solid green represents the max linear correlation (+1) and the solid red for no linear correlation (0).

It is not difficult to see a small group walking in lockstep while solidly headed (dragged?) by King Bitcoin. I do have my explanation but am damn curious to learn about yours.

Please chime in.

If we extend the concept to cryptocurrencies and make the measurements for the last 30 days we obtain the table above. (Thank you, John Young!) Solid green represents the max linear correlation (+1) and the solid red for no linear correlation (0).

It is not difficult to see a small group walking in lockstep while solidly headed (dragged?) by King Bitcoin. I do have my explanation but am damn curious to learn about yours.

Please chime in.

Comments

Post a Comment